12th May 2020

Chris Watson briefly outlines the main legal features of an Individual Service Fund (ISF) and explores how community hubs or micro-enterprises might use them.

Author: Chris Watson

A couple of weeks ago we had an entertaining and enlightening afternoon webinar session with Belinda Schwehr (CASCAIDr) on all things Individual Service Funds and Direct Payment related (the full video of the session will be available online soon). We also touched on some of the main impacts of the Coronavirus Bill and the care act easements.

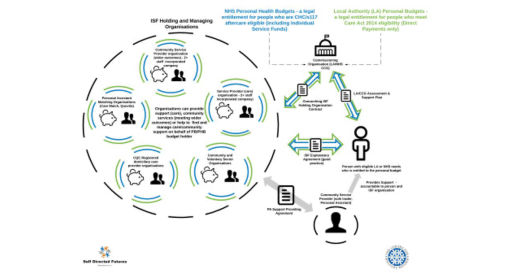

Alongside this we also talked about how micro-enterprises could hold Individual Service Funds (ISFs) and what the contracting arrangements could look like in setting these up. There were some elements of our thinking that we had confirmed again and also some interesting new lessons from a legal perspective, the highlights being:

Any individual personal assistant that sets up as a sole trader locally to provide support will effectively have to be paid by the person they support via a direct payment (DP) or alternatively they would need to connect with an umbrella organisation who would hold and manage the ISF payments as a commissioned service on behalf of the person. The umbrella organisation could be a local neighbourhood community hub that decides it can support and oversee local PA’s or a more specialised care and support centric organisation. If a group of two or more PA’s decide to get together and form into a small company then this is of course absolutely fine for holding ISF’s and/or DP’s.

I’ve had a go at creating an illustration (below) to explain some of this in relation to where individual PA's and Micro enterprises fit together - in essence an ISF is a form of sub-contracting that is managed and overseen by the ISF holding organisation who holds an overarching contract with the commissioner allowing them to do this.

The publisher is the Centre for Welfare Reform.

Contracting for Individual Service Funds (ISFs) © Chris Watson 2020.

All Rights Reserved. No part of this paper may be reproduced in any form without permission from the publisher except for the quotation of brief passages in reviews.